- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

Hazeran Çekmeceli Dolap

Hazeran Çekmeceli Dolap

₺34,000.00₺31,200.00

-

- Yaşam Tarzı

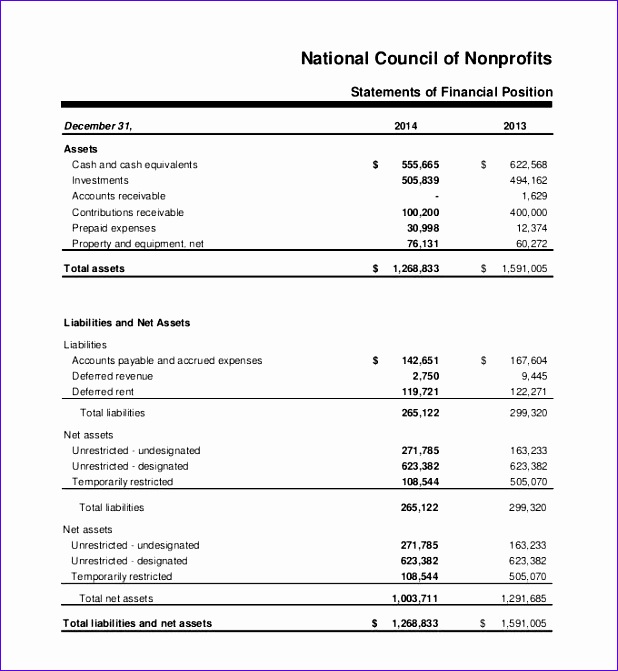

Statement of Financial Position: Reading a Nonprofit Balance Sheet

Plus, they’re all useful resources when it comes to filing your organization’s annual Form 990 with the IRS. Most nonprofit-friendly accounting software like QuickBooks Aplos or Nonprofit Treasurer will allow you to generate financial statements automatically. Although it’s possible to manually generate financial statements from your ledger how to void a check or spreadsheet, it takes a ton of accounting knowledge and time to do it right. In most cases, it’s better to let your accounting software or a bookkeeper take care of this step for you. Nonprofits must file financial statements with the IRS to follow compliance laws, which is not the only reason they should include these activities.

Nonprofit Balance Sheet Framework

Cash basis accounting is simpler and easier to understand compared to accrual basis accounting, which is commonly used in for-profit organizations. However, it may not provide a complete picture of the organization’s financial health. It is important for nonprofit organizations to carefully consider their accounting policies and choose the method that best suits their needs and goals.

Understanding the Liabilities Section

By disclosing these risks, organizations can inform stakeholders about the potential challenges they may face and the steps they are taking to mitigate them. Federal grants can provide essential funding for nonprofits, but managing these grants requires a thorough understanding of federal requirements and meticulous compliance. Here’s a comprehensive deep dive into what nonprofit leaders need to know to successfully…

- These funds are subject to restrictions and can only be used for the specified purposes.

- This ratio measures the percentage of expenses that a nonprofit organization is spending on its core mission.

- While not always required, audits are often necessary for larger organizations or those that receive government grants.

- This report can help you explain to your board why you have less cash even after a great fundraising month (maybe you invested in some much-needed equipment).

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

How can Taxfyle help?

By monitoring and evaluating the performance of their investments, nonprofits can make informed decisions to optimize their financial resources. Balance sheet is a crucial component of financial reporting for both for-profit and nonprofit organizations. It provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. This financial statement is essential for stakeholders to assess the financial health and performance of an organization.

Implement our API within your platform to provide your clients with accounting services. Examples include outstanding bills, accrued expenses, payroll and payroll tax liabilities, lines of credit, and short-term loans. You’ll find your organization’s liabilities organized by current and non-current liabilities on the Statement of Financial Position.

Understanding the different categories of net assets, including unrestricted and restricted, is essential for effective financial management and decision-making. In simple terms, nonprofit financial statements are like a financial snapshot of an organization. They show how much money the organization has, how it is being used, and where it is coming from. These statements are crucial for transparency and accountability, as they allow stakeholders to assess the organization’s financial stability and make informed decisions. These financial statements are crucial for stakeholders to assess the financial performance and stability of a nonprofit organization. They provide valuable insights into the organization’s financial position, revenue sources, expenses, and cash management.

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

A nonprofit’s statement of financial position can tell you how well the organization is performing financially at a given moment in time. Generally, a healthy nonprofit will have assets that are greater than their liabilities, and their net assets will have a large surplus that can be used to achieve its future goals. The Statement of Cash Flows shows the cash inflows and outflows from operating, investing, and financing activities of a nonprofit organization over a specific period.

This section highlights the sources of revenue and support, as well as the expenses incurred by the organization. It gives insight into the organization’s financial performance and whether it is generating enough revenue to cover its expenses. The table should include the dollar amounts for each category and provide a total for the net assets. This allows readers to easily understand the composition of the organization’s net assets and the overall financial position.

The difference between Revenues and Expenses is reported as Change in Net Assets. Take the first example above – paying a security deposit for an event venue. A security deposit is not an expense because you will get that money back after the event (assuming no damage!).