- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

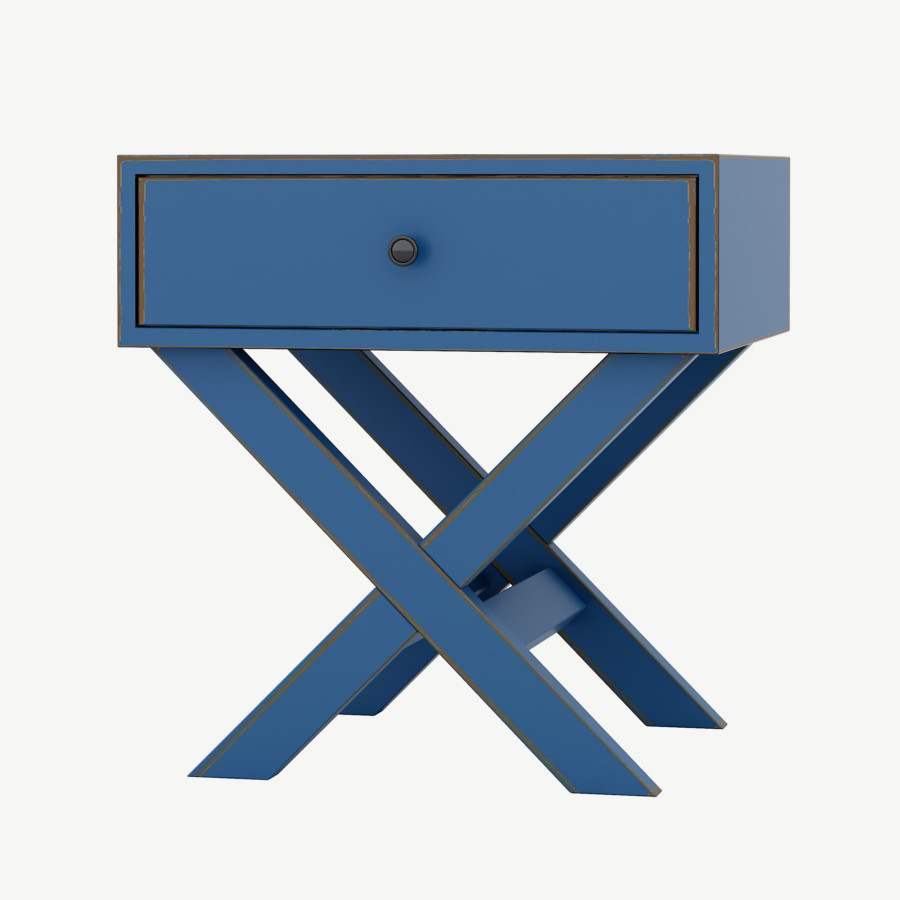

Piccolo Komodin

Piccolo Komodin

₺22,420.00₺16,575.00

-

- Yaşam Tarzı

USDA Lenders: Everything you need to See

Maybe you have observed a USDA Mortgage? What are the certain information about they and you can if or not or not youre qualified? Really does the very thought of residing a rural city notice your? Think about providing a tremendous amount for the a home loan? If so, read on to get more info.

While you are town life is good for certain. There are various people which like the beautiful setup of outlying The united states. The fresh new wonderful running flatlands, overgrown pastures, and you will woods that appear to safeguard an enthusiastic undisturbed community. If you’d like an existence in the country, after that a USDA Home loan is the perfect chance for you and then make you to fantasy possible.

What is actually Good USDA Mortgage?

An effective USDA Financial is simply a mortgage system which is financed through the Us Institution regarding Agriculture (USDA). The newest USDA is started in the 1930’s as part of the brand new The fresh new Deal. During a period when most rural casing didn’t have running water, plumbing system, otherwise power. It absolutely was an organization you to began into the purpose of improving the grade of lifestyle inside the outlying America. It absolutely was established towards mission of giving the Western a very good household and a suitable way of life ecosystem.

Now its rural innovation system remains probably one of the most underutilized mortgage apps in america. Possibly because it is a lot less really-also known as some of the a lot more popular apps such as the Down Fee Direction otherwise FHA programs. It could be because individuals are unnerved because of the qualifications criteria. Whether or not it isn’t to you, this might be a home loan merchandise that someone you know might take advantage of.

For over eighty many years, the newest USDA has been helping low to reasonable earnings family the along side nation obtain safe, safer, and you may sensible construction. This new USDA, even today, has been taking sensible housing to People in the us that have reasonable to moderate earnings. Indeed, he has got a portfolio worthy of over 216 billion into the finance and you will plan to give over 38 billion inside the financing regarding the fiscal seasons. Into the 2017 by yourself it aided 127,000 family members enter into outlying residential property. You could be next loved ones to get to 100% investment and shell out 0% off. It’s perhaps one of the most glamorous financial apps online, however you will find a capture.

USDA Rural Development Financing Qualifications

To be entitled to a good USDA Outlying Development Loan you have got to fulfill certain requirements. These types of qualification criteria was in fact put in place with the intention that family in need were the ones capitalizing on the application. In addition, these types of conditions had been built to satisfy the biggest goal of USDA, that is to change the standard of lives from inside the Outlying The usa.

Knowing whenever you are qualified, earliest you should consider your own economic situation. New USDA makes it necessary that people obtaining a rural home loan let you know a capability to pay financing, but fall under the reduced so you can modest money bracket. The exact domestic earnings they need depends upon the room that the newest property is into the while the sized the house.

Usually if the annual household earnings is actually between 30,350 to 86,850 there try 1-cuatro persons on your own family youre eligible. If your house are bigger than their annual earnings are going to be huge too, however, will be nonetheless slip below 114,650.

Recall this ought to be the full income of everybody surviving in your house. Specific exclusions are cities instance Robins Condition from inside the Colorado, with a full time income restriction away from 104,800 to possess a-1-cuatro individual family and you will 138,350 having an effective 5-8 people household. If a place is far more high priced then earnings restrict usually change loans Weston to reflect the price of one to urban area.