- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

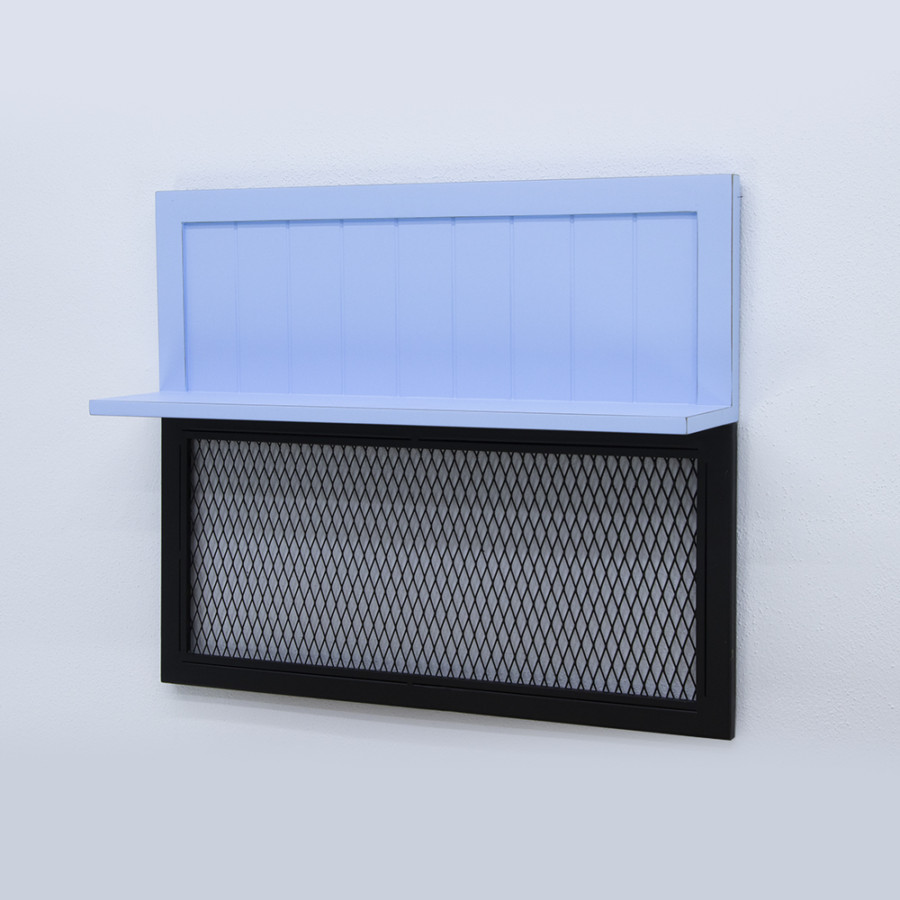

Hammond Duvar Rafı

Hammond Duvar Rafı

₺14,896.00₺12,265.50

-

- Yaşam Tarzı

By law, our home mortgage system is meant to turn a profit such most other your retirement finance assets

CalSTRS mortgage brokers: also high-risk, expensive?

CalSTRS authorities is wanting to know if an effective $step 1 mil home loan system, roaring on wake of your a residential property freeze, is just too risky towards the retirement money and you will putting instructors on residential property they can not pay for.

The applying which enables instructors to invest in property that have an effective low down percentage, 3 % of purchase price, did more providers this past year compared to the prior 5 years shared.

Teachers be eligible for mortgage loans according to 80 % of really worth of the house. The secret to the application form would be the fact 17 per cent of your own price is included by the an extra financial, about what money try put off for five decades.

But in the post-crash world, the brand new California Condition Coaches Old age System can no longer get insurance coverage with the second mortgages or sell them in the market.

The new accounting laws require your next mortgage loans getting persisted brand new guides from the market value, now a projected ninety percent lower than their costs.

When home values and you may salaries have been going up every year, teachers which have expanding profits may use the increased collateral in their house so you can re-finance the following mortgages just before costs become after five age.

There is question that homebuyers, immediately following five years, may suffer he is being struck having an unaffordable “balloon” percentage. Our home financing system to possess educators has a foreclosure speed well below average at this point.

But on a great CalSTRS panel appointment a week ago, discover suspicion on whether or not the foreclosure speed may differ. Absolutely nothing study are available on the number of residential property on system that are “under water,“ really worth below due towards the home loan.

Solange Brooks, a good CalSTRS capital officer, advised the brand new panel one a national system can assist educators into the the applying re-finance the original mortgage toward 80 per cent of the purchase price, but it does perhaps not safeguards 2nd mortgages.

One method to look at the situation, told you Brooks, would be the fact of many homebuyers, particular that have help from the new government system, should be able to refinance the first-mortgage, making it simpler to start percentage on the 2nd home loan.

“The other answer to view it was i have amazing chance making use of next mortgages we have been holding, while the we cannot offer them,” Brooks said.

Calpensions

Chris Ailman, the latest CalSTRS master financing manager, told you perceptions enjoys changed since the crash. The thing that was immediately following viewed as and also make housing affordable happens to be regarded as from the certain banks just like the “bad amortizing,” in which financial obligation grows even after monthly premiums.

“The audience is being qualified people having property they cannot afford,” said Ailman. “They can just be able to pay for 80 % of the domestic, yet our company is capital to own 100 percent.”

“Just before 2008 which had been a good thing and part of the 3rd toes of your own feces (a retirement having retirement, personal financial support, family security),” the guy said. “I’m having a completely new fresh direction on: So is this really the great thing to possess teachers otherwise was we suckering them from inside the?”

Ailman told you there is a created-incompatible involving the focus of your own board to add a home-to find benefit getting players and legislation requiring that investment feel meant to give a revenue.

CalSTRS began their financial program in 1984 with fixed-speed mortgage loans to own fifteen years and 30 years. Into the 2000 CalSTRS added a no advance payment system with a beneficial first mortgage to your 95 percent of the cost and you can good second financial to your 5 percent.

The fresh “95/5” program is frozen inside the due to markets requirements while the inability to acquire insurance coverage. But the “” system started inside the 2001 not simply continues, but had a growth spurt just last year.

The low advance payment system are 90 per cent of one’s cuatro,351 mortgage loans worthy of $727.8 billion issued due to CalSTRS this past year – over the complete out-of loans provided on five early in the day ages.

Once the 1987, the fresh new CalSTRS mortgage program keeps issued 39,556 mortgages value $5.step 3 mil. More than $step 1 billion of overall is granted from the a few lower downpayment software.

Nationwide, a firm connected with subprime mortgages and other trouble, turned into the latest “master servicing representative” of your own CalSTRS mortgage system inside the 2004. The financial institution of The usa, just after acquiring Nationwide, took over the task when you look at the 2008.

A person in the CalSTRS board, county Control John Chiang, received good lerica associate after wondering the staff towards home mortgage system.

CalSTRS panel affiliate Carolyn Widener ideal one CalSTRS sign-up along with other personal retirement benefits to seek government relief. She try told that CalSTRS and also the California Social Teams Old-age Program are some of the pair having mortgage applications.

The newest CalPERS system begun within the 1981 had given 133,000 home loans worthy of $21 million towards the end out-of 2008. This new CalPERS system has several low down percentage possibilities, you to definitely requiring “as little as $five hundred from the financing.”

Just last year CalPERS suspended a good “float down feature” giving the consumer a decreased of the rates of interest plus is actually frozen.

Financing too big is secured from the federal businesses were physically owned by CalPERS. Brand new “entire financing” program got a relatively large delinquency rates, eight.8 per cent, and CalPERS stated shedding $step 3 million on system because the 1997.

The newest sprawling CalPERS mortgage system has actually 29 loan providers and you will from the step three,000 formal loan officers. Into the , CitiMortgage, let go the fresh California employees that had been controlling the program.

This new CalPERS panel is advised later this past year your system has started to become are run of the CitiMortgage team when you look at wikipedia reference the Dallas and lots of CalPERS professionals. But there’ve been “a drop from inside the customer care and you may quality control.”

CitiMortgage won’t “put tips.” So CalPERS intentions to look for a special director, and therefore when CalPERS required estimates to deal with the application.

Inspite of the difficulties, the home loan apps keeps good service into the retirement chatrooms. In the CalSTRS, Widener advised the employees so you can enjoy deep when you look at the an analysis regarding the applying and to think possibilities.

“Let’s see if we could remain our dedication to make an effort to help instructors generate wealth such as this, whilst possess across the overall become a whole lot a great case of making instructors middle class,” Widener said.

“Owning a residential property possess extremely over it,” she said. “It offers provided them chances extremely in order to become people in the guts classification, and in addition we have inked a beneficial occupations of helping.”