- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

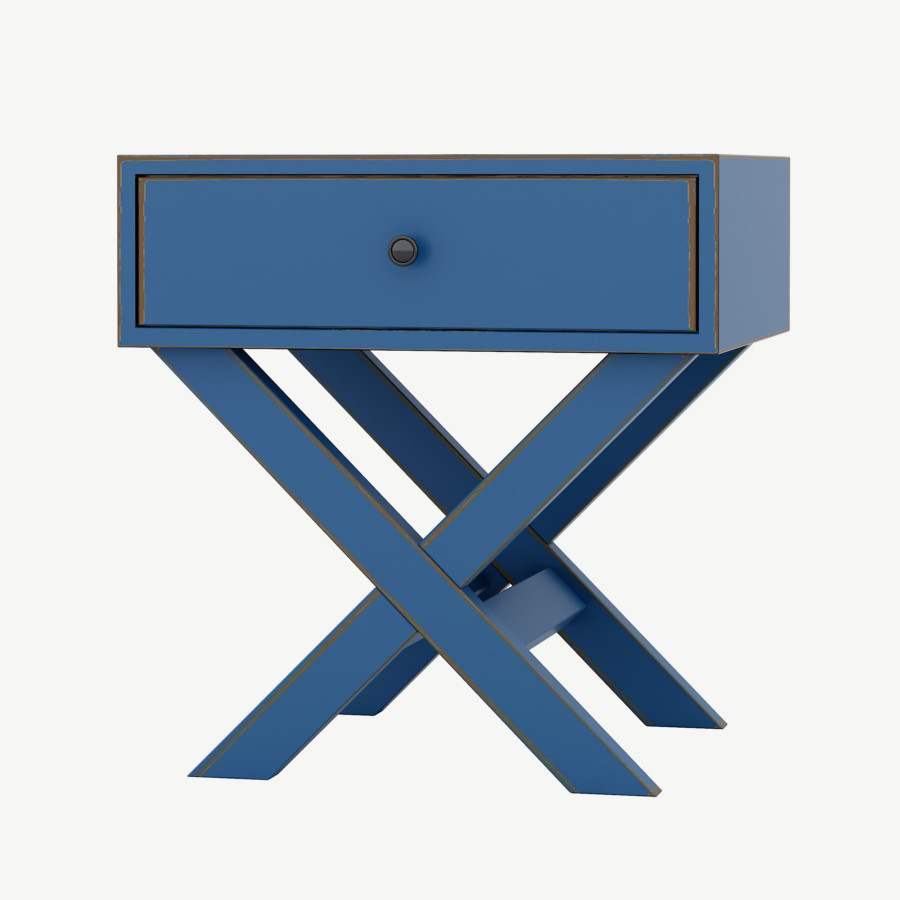

Piccolo Komodin

Piccolo Komodin

₺22,420.00₺16,575.00

-

- Yaşam Tarzı

During the u, Mortgage brokers Chairman David Schneider waiting an internal demonstration named, “Mortgage brokers Facts, Additional & Internal Opinions

” |202| The new demonstration try retrospective, taking timelines off WaMu’s biggest strategy, rules, and you can teams change. The original substantive web page of the presentation contains the fresh going, “Three important providers changes took place Home loans which millennium hence formed the results and you may standing for the an explosive aggressive landscape”:

Mr. Scheider’s retrospective presentation of your alter one to happened within WaMu try unambiguous: because of the 2006, WaMu got “targeted production team with the higher elizabeth speech, you to model alter and lower income volatility having WaMu by the minimize contact with Financial Repair Legal rights. |204| After slides promote greater detail. A great quarterly timeline was served with this new supposed: “For the a whole lot of external and internal higher-measure change, Mortgage brokers got bold measures in order to redefine the team into a great green model.” On approach section towards the next one-fourth regarding 2006, Mr. Schneider composed: “New clients model, higher margin issues.” |205|

Even with warnings from the specific within its administration concerning the unsustainable property price ripple, WaMu pursued a leading Risk Financing Solution to create short-term profits about advantageous acquire-on-sales margins given by Wall Street having high-risk money and securitizations, for which the financing get enterprises went on so you’re able to award AAA analysis. To succeed, the methods was premised on borrowers being able to re-finance otherwise sell their houses to repay its funds even in the event from a default. Flat otherwise declining family prices generated refinancing and household conversion process a lot more difficult.

Effective utilization of brand new High risk Financing Strategy and additionally required robust exposure administration. But if you’re WaMu was incurring even more borrowing from the bank risk than simply it had prior to now, chance executives was u’s sections.

Notes

138. Come across step 1/2005 “Higher risk Credit Means Investment Allotment Step,'” published to Washington Shared Panel off Directors Financing Committee Discussion, JPM_WM00302975-93, Reading Exhibit cuatro/13-2a. [Back]

Thus, whenever credit exposure administration is actually very expected, WaMu found by itself with a lack of productive exposure government and you will supervision

139. Get a hold of, e.g., “Asset Allotment Initiative: Higher risk Lending Approach and you can Enhanced Borrowing Chance Management,” Washington Common Board regarding Directors Dialogue, JPM_WM04107995-8008, Reading Display 4/13- 2b; 1/2005 “Greater risk Financing Approach Advantage Allotment Effort,'” submitted to Washington Shared Panel of Directors Fund Committee Talk, JPM_WM00302975-93, Reading Showcase cuatro/13-2a. [Back]

143. See 8/2006 Arizona Shared inner statement, “Solution Arm Credit Risk,” graph titled, “Borrower-Selected Payment Choices,” in the seven, Reading Display cuatro/13-37. The latest WaMu report together with mentioned: “Nearly all Solution Arm borrowers get the lowest commission each month that have high persistency, despite changes in the interest pricing otherwise fee changes.” Id. at the dos. [Back]

154. 6/ OTS Memo to Lawrence Carter out of Zalka Ancely, OTSWME04-0000005357 at the 61 (“Shared Memo #nine loans Alamosa CO – Subprime Lending Approach”); 3/ OTS Report regarding Test, in the OTSWMS04-0000001483, Reading Display 4/16-94 [Sealed Exhibit]. Pick including 1/2005 “Higher risk Credit Approach Demonstration,” published to Washington Common Board of Directors, at JPM_WM00302978, Hearing Showcase 4/13-2a (“Even as we use our very own Proper Bundle, we must target OTS/FDIC 2004 Security and you may Soundness Exam Joint Memos 8 & nine . . . Mutual Memo nine: Generate and present a good SubPrime/Higher risk Financing Strategy to new Board.”). [Back]

155. 1/2005 “Higher risk Financing Method Demonstration,” submitted to Washington Common Panel out of Directors, at the JPM_WM00302978, Reading Exhibit 4/13-2a; find also cuatro/2010 “WaMu Device Originations and Orders of the Payment 2003-2007,” graph served by the newest Subcommittee, Reading Exhibit 4/13-1i. [Back]

156. 4/ Washington Mutual Lenders Discussion board regarding Directors Meeting, from the JPM_WM00690894, Reading Showcase cuatro/13-step three (discover graph exhibiting acquire at discount having regulators funds is actually 13; to own 31-season, fixed rate finance is actually 19; for alternative financing was 109; for domestic guarantee money is 113; as well as subprime money are 150.). [Back]