- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

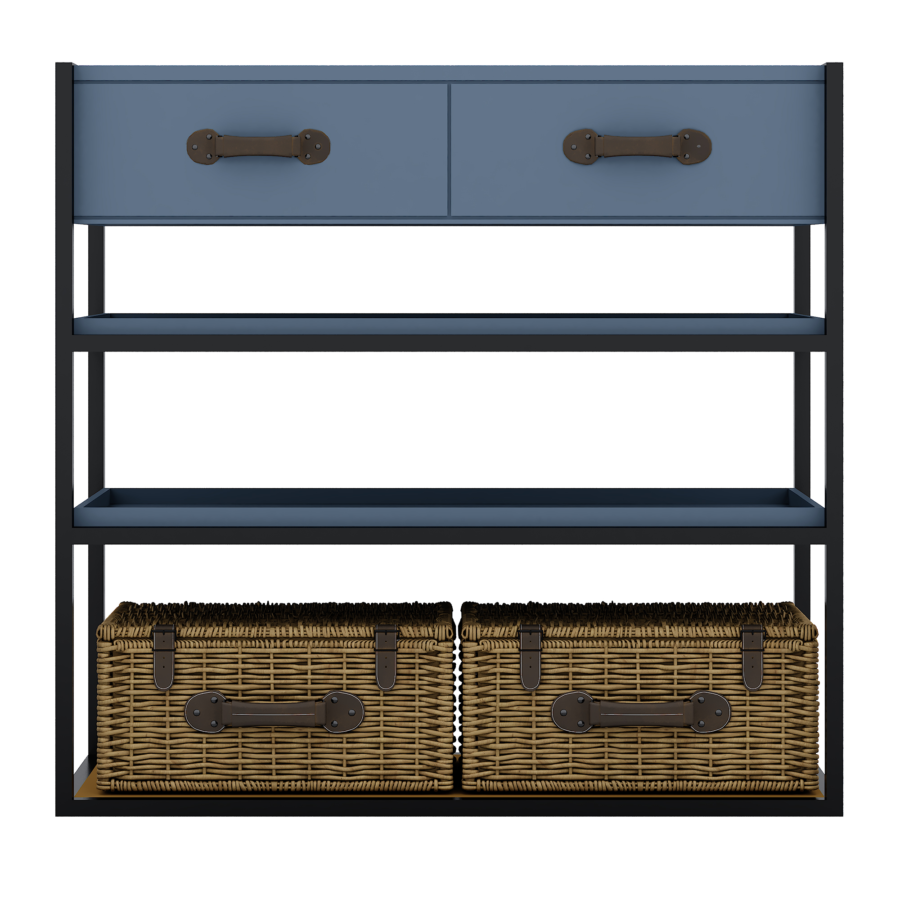

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

The brand new fully on the internet app causes it to be without headaches locate been

Show this particular article

FOOTHILL Farm, Calif. , /PRNewswire/ — loanDepot, Inc. (“LDI” or “Company”) (NYSE: LDI), one of the state’s prominent non-lender retail mortgage brokers, now delivered an innovative digital domestic guarantee credit line (HELOC). Playing with an advanced technology platform permitted by digital systems and you will investigation, so it latest service gets property owners a robust option for dealing with rising prices and you can rising personal debt that have a level of electronic ease, convenience and you will rate so you can resource maybe not available today because of antique HELOC facts.

The fresh hallmarks of your loanDepot Electronic HELOC is actually electronic simplicity and you will rate, with a length of time out of software so you’re able to closing within one week. Consumers will get a zero-hassle, online payday loans Eclectic rates estimate in under five minutes and certainly will pre-qualify with no bad impact on their fico scores. After that, advanced digital systems and automatic procedure wil dramatically reduce the newest rubbing and time-lag with the a generally ineffective, paper-built loan recognition and you will investment techniques. Customers can do their whole loan process on line but may also have access to gifted, signed up mortgage officials to support all of them from the procedure.

Brand new launch of the brand new loanDepot HELOC comes during the a critical day for Western households grappling into compounding financial challenges from rising prices, high living expenses and ascending rates. Meanwhile, an upswing inside assets opinions more than the past several years features lead to home owners wearing the latest wealth owing to checklist degrees of family guarantee. Having mediocre domestic equity now at $3 hundred,000 1 , the latest loanDepot HELOC brings residents an intelligent brand new selection for leverage their guarantee to reach the monetary specifications.

“Consumers are selecting choices to assist do brand new impression from ascending interest levels and higher rising cost of living,” said loanDepot, Inc. President and Chief executive officer Honest Martell . “With family equity on a the majority of-go out highest, of several people manage benefit considerably regarding a less complicated and you will less ways to gain access to the importance inside their home. Our very own electronic HELOC, supported by the strength of the federal community from licensed financing officers, diverse customers engagement channels and leading individual brand name, leaves all of us for the a fantastic reputation to assist them.”

“Creativity is actually our DNA and loanDepot’s the newest electronic HELOC was a different example of exactly how we fool around with today’s technology to evolve the fresh lifetime in our users and you will submit a superb experience. Whether or not these are typically paying high-appeal personal debt, improving their property otherwise sending a baby to school, we’ve got created an end-to-avoid digital sense, leverage leading edge tech for property valuation, borrowing from the bank and you will earnings confirmation, that provides people usage of finance with rate and you will convenience to improve their budget,” said loanDepot, Inc. Digital Products and services President Zeenat Sidi . “In the current tiring economic ecosystem where people are looking simplicity, benefits and you may rate, loanDepot’s electronic HELOC ‘s the wise possibilities.”

Residents have access to $fifty,000 so you’re able to $250,000 from collateral because of a great ten-seasons interest-just personal line of credit accompanied by a 20-year changeable repayment title without prepayment punishment.

Within the phased federal roll-out, the new loanDepot Electronic HELOC is obtainable now in Pennsylvania , California , Florida , Arizona and Washington , and will be delivered for the says across the country because of the early 2023.

LoanDepot’s floor-breaking digital house collateral credit line (HELOC) takes people off price to close in as little as 7 months

Forward-Appearing StatementsThis press release can get incorporate “forward-looking comments,” and therefore mirror loanDepot’s most recent viewpoints when it comes to, among other things, its functions. You could potentially identify this type of statements by way of words instance because “frame of mind,” “potential,” “remain,” “get,” “search,” “whenever,” “assume,” “faith,” “anticipate,” “bundle,” “desire,” “estimate” otherwise “anticipate” and you will similar terms or perhaps the bad products ones terms or similar words, also coming otherwise conditional verbs such as for instance “will,” “is,” “would” and “you are going to.” Such forward-searching statements are derived from most recent offered doing work, monetary, monetary and other information, as they are maybe not guarantees out of future efficiency and are usually at the mercy of threats, concerns and you may assumptions, like the dangers about “Exposure Facts” part of loanDepot, Inc.is the reason Yearly Report on Mode ten-K for the year ended , which happen to be tough to assume. Hence, current arrangements, anticipated measures, monetary performance, and envisioned growth of the, can vary materially about what is actually indicated or estimated in just about any forward-looking statement. loanDepot will not deal with people obligations so you can in public up-date otherwise revise one submit-appearing statement so you can mirror coming occurrences otherwise facts, except as needed because of the appropriate rules.

Regarding the loanDepotloanDepot (NYSE: LDI) try an electronic trade organization purchased providing their people through the the house ownership trip. While the its launch this season, loanDepot provides revolutionized the mortgage globe having a digital-basic method which makes it much easier, smaller and less exhausting to get or refinance a home. Now, as among the state’s prominent non-lender retail lenders, loanDepot allows people to really have the American dream about homeownership due to a broad room regarding financing and you will a property characteristics one to explain among life’s extremely advanced transactions. With headquarters during the Southern area Ca and you can organizations all over the country, loanDepot try purchased offering brand new teams in which their cluster lifetime and functions owing to various local, regional and you will national philanthropic work.