- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

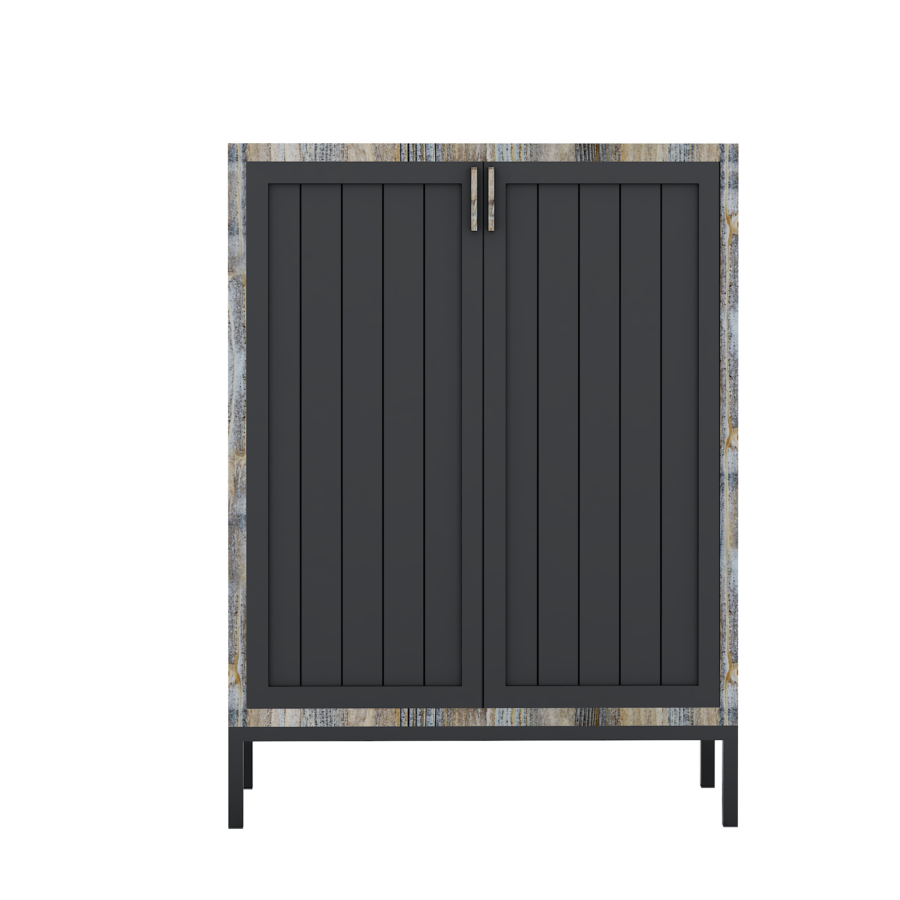

Ladin Dolap

Ladin Dolap

₺40,280.00₺33,150.00

-

- Yaşam Tarzı

A means to finance a home beyond your Uk

Get independent suggestions

Out-of tax and you can probably outstanding electric bills, there is a lot to think about when selecting property external the uk. The method for choosing a property tends to be a little some other. Your own home loan provider, monetary adviser otherwise lawyer can give let. But but you ought to funds longer, time and additional money than simply you would for buying a house in britain.

Brand new International, Commonwealth & Invention Work environment (FCDO) recommends you will get independent courtroom and you can financial pointers at each and every stage of your own buying processes. It offers a list of English-talking solicitors and you may interpreters and you may translators in various nations to simply help your.

The agent can deal with more than just the new files on it during the buying a house outside of the British. They’re able to along with give you worthwhile insight into the region and you may prospective problems of regional control. You need to use a legal professional who is always regional assets law, fluent in the regional vocabulary (and you will English), and you may completely independent.

Protections and you may legislation are various other

If you’re to shop for possessions away from Uk, make sure there is the courtroom protections need. You will not be included in the new Monetary Ombudsman Services otherwise Financial Functions Settlement Strategy thus you’re going to be relying on neighborhood courtroom program and you will any extra protections your attorney get negotiate for your requirements.

Heredity laws is dissimilar to the uk, so you could must draft a may from the country otherwise part where you are buying a property. Which means it would be passed down considering your desires. Furthermore really worth looking at just how a hereditary property can be taxed, in order to check out the lengthened-name impacts.

There could be different options on the best way to money a home outside of the United kingdom, be it a holiday house, a financial investment otherwise a place to retire to.

Arrange a worldwide financial

When you need to utilize the assets alone as defense, you will likely need a home loan regarding a bank otherwise other lender in the united states we need to buy inside. You can also use a specialist agent.

To buy property outside of the British is likely to be extremely different to doing this home. Non-owners might need to set-out more substantial put having a mortgage, as compared to owners.

Bear in mind the excess threats. For example, in case the income is within another money towards the around the globe mortgage, there clearly was a risk that rate of exchange motion may affect your capability to expend. And you may, if you find yourself allowing the property, you will have to security the mortgage repayments, even if your property is empty.

Particular British banks, as well as HSBC, offer worldwide financial features to really make the techniques smoother. When the eligible, you will be in a position to make an application for a major international mortgage. You’ll want to make sure that we help your favorite country.

Launch guarantee from your own United kingdom home

Home guarantee ‘s the property value your house, quicker the amount of people outstanding financing shielded involved, such as for instance home financing. Such as, if the mortgage equilibrium is actually ?100,000 and your residence is really worth ?400,000, you have ?300,000 equity throughout the property.

Whenever you afford to, you may want to think launching guarantee from the British family, and utilizing that money to pay for a home beyond your Uk.

When you use more money against your property, the size of their financial and your month-to-month repayments increases. You really need to be sure to can afford the fresh money in order to prevent their British house getting repossessed.

Home prices can go off and additionally upwards. Should your value of your United kingdom home drops, you might enter negative collateral where you borrowed extra cash than simply your home is worthy of. A switch to rate of exchange might also affect the worthy of inside the weight sterling of the buy outside of the https://paydayloanalabama.com/mooresville/ British.

If you possess the funds already, purchasing a home outside the British inside the dollars is defeat the brand new pressures out-of borrowing money. It is important that one may pay the possessions and also have sufficient discounts to fund costs, particularly: