- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

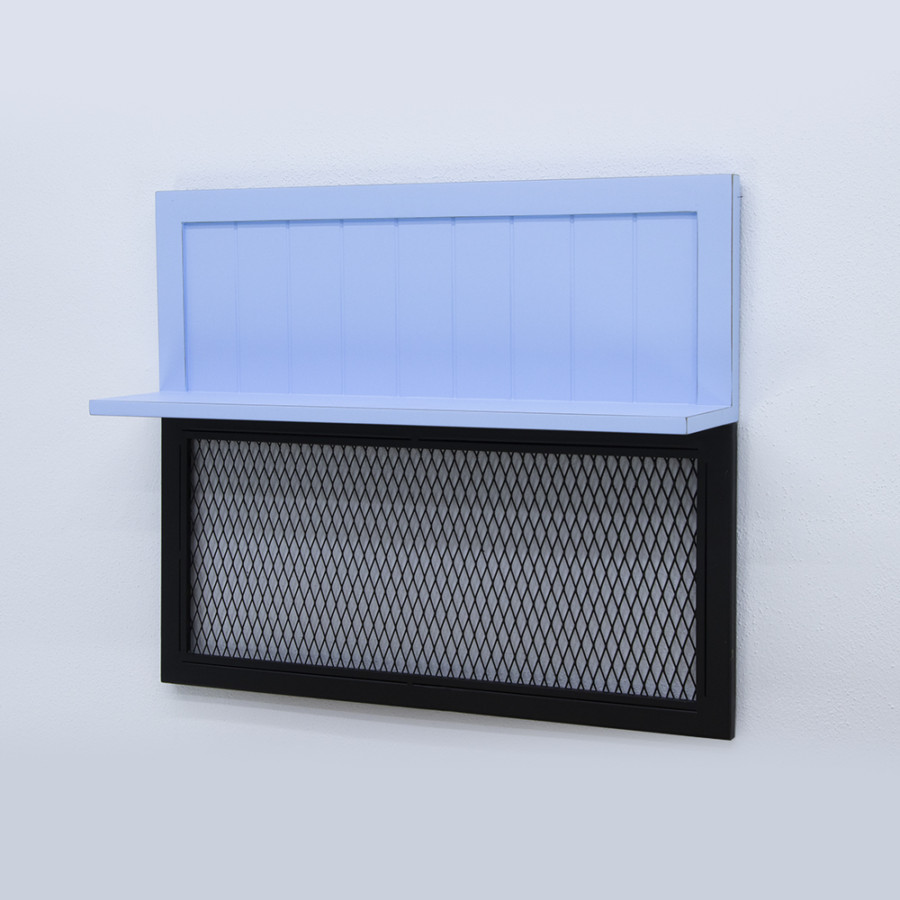

Hammond Duvar Rafı

Hammond Duvar Rafı

₺14,896.00₺12,265.50

-

- Yaşam Tarzı

Woodforest National Lender is actually personally possessed and you can our Staff member Inventory Ownership Package is the prominent stockholder

How exactly to discuss loan situations from the switching the house Value?

Transform toward Value of you’ll change the contributes to an excellent high ways. Lendersa sliders enables you to create timely change to explore your own financial support solutions.

- Go into the Loan amount by hand during the Amount borrowed package.

- Go into the Price by hand within the Value of box.

You could potentially replace the value of from the swinging the house Really worth slider right up otherwise down or from the typing a unique Property value yourself regarding Worth of container.

Once you change the Worth of, precisely the LTV varies, plus the Amount borrowed will continue to be a similar Loan amount.

Just how to talk about financing situations by the changing the borrowed funds Amount?

Alter toward amount borrowed, in spite of this a bit, you will replace the contributes to a critical way. Lendersa sliders will let you generate prompt changes to understand more about their investment options.

- Enter the Loan amount manually within the Amount borrowed field.

- Enter the Cost yourself into the Worth of container.

- There are 2 ways to alter the Amount borrowed to the sliders:

Replace the Amount borrowed by swinging the loan Count slider. (Brand new LTV varies, additionally the Worth of will stay intact).

How-to speak about loan problems by the changing the fresh LTV Slider?

LTV is the abbreviation from Financing In order to Value, and is the brand new ratio between your Amount borrowed in addition to Property value. The new formula in order to assess LTV are Amount borrowed split up of the worth of.

Alter toward LTV, however some, you certainly will replace the causes a significant ways. Lendersa sliders enables you to make quick alter to understand more about the funding options.

- Go into the Loan amount yourself for the Loan amount box.

- Go into the Price by hand within the Property value box.

- There are 3 ways to change the fresh LTV:

Change the Amount borrowed from the swinging the mortgage Matter slider. (The fresh LTV may differ, and also the Worth of will stay undamaged).

Lendersa Complex Calculator

This new Demo calculator and also the Tough Money Calculator leave you a beneficial general imagine to payday loans Mississippi the particular financing you can expect in order to get. The next thing up try Lendersa Advanced Calculator, the ultimate lending calculator and you will a beneficial quantum lip over other mortgage calculator in existence.

Lendersa Complex Calculator is more diverse and effective compared to the Hard Currency Calculator, and the Demonstration Calculator. It provides all research fields wanted to dictate their qualifications for your financing.If you’re not sure on what loan you can buy, following play with Lendersa Complex Calculator instead of the Hard Currency Calculator. Begin by entering the sorts of assets plus postcode and click the new Explore The options button.

- Traditional?

The improvement calculator allows you to explore Lendersa LoanImprove engine to optimize the loan request so even more lenders would want to compete on privilege od arranging your loan.

In the LoanScore

LoanScore (Mortgage Danger of Profits Rating) actions the chance to get playing lenders who’ve complimentary financing apps with the debtor financing request. A borrower can also be talk about of many inquiries and found numerous outcomes for each inquiry with exclusive LoanScore for each impact. The fresh new LoanScore imply into debtor the quantity in addition to top-notch the latest lenders who happen to be finding thinking about their mortgage demand. The newest LoanScore results start from 0 to 99. A premier LoanScore (Age.g., over 80) means of several desperate loan providers that happen to be seeking planning the mortgage according to research by the borrower request. A minimal LoanScore means zero otherwise not too many loan providers with a number of complimentary apps. Lendersa loan optimisation is an exclusive process the fresh new borrower can deal with to improve the results out of his mortgage request and you may raise LoanScore.

What’s the other anywhere between LoanScore and you can Fico score? LoanScore and you can Fico Get are completely various other ratings. FICO, otherwise Reasonable Isaac, credit scores is a method of quantifying and you will contrasting an individual’s creditworthiness. Credit scores cover anything from 300 in order to 850. Fico Score scale your credit rating; its centered on your credit score. LoanScore (Loan Chance of Profits Get) actions the possibility you are going to receive financing also offers out of lenders established in your mortgage consult as well as your monetary official certification. The fresh LoanScore diversity try away from 0 so you’re able to 99. A good Fico rating typically helps raise the LoanScore, however it is merely part of the LoanScore. It is possible to has actually finest Fico get regarding 850 and you can LoanScore off 0; it means one to inspite of the advanced level borrowing from the bank, there are not any financing software being matching your own borrower’s need. And vice-versa, you will get a poor credit score off 350 Fico and you will LoanScore out of 99, which will be you can easily when you demand financing predicated on guarantee just in addition to loan providers your investment credit rating. Each loan system has its unique LoanScore. Each time you replace your mortgage request, the fresh programs transform, in addition to LoanScore each and every system alter immediately and you can automatically the newest Fico rating remains a comparable unless you manually turn it.