- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

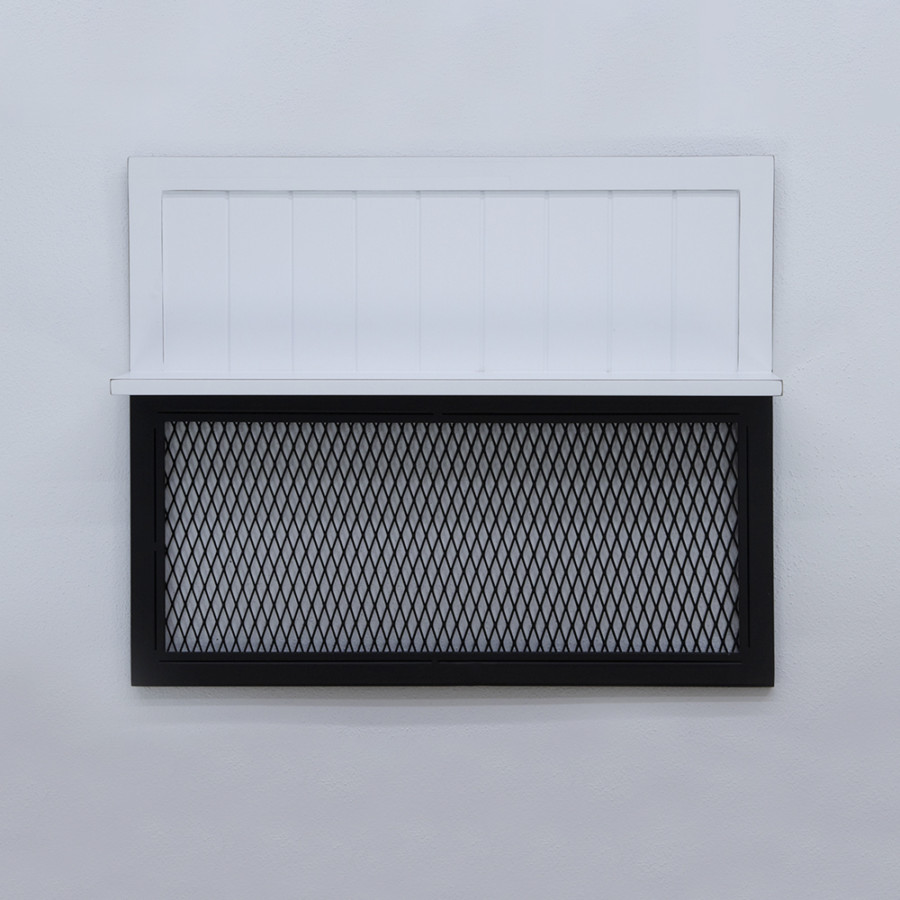

Hammond Duvar Rafı

Hammond Duvar Rafı

₺13,376.00₺10,342.80

-

- Yaşam Tarzı

Helpful tips on how best to Down load and look The HDFC Home Financing Declaration – Step-by-Action Procedure

Being able to access and you will reviewing your HDFC Mortgage statement on the net is a beneficial easy processes designed to render convenience and you may results. For HDFC Lender consumers, that it facility allows a straightforward overview of mortgage statements, guaranteeing he’s current on their loan standing, in addition to principal and you will attention portion, and certainly will create the profit ideal. Its like useful for pinpointing one inaccuracies very early and you can understanding how for every percentage impacts the mortgage equilibrium.

Additionally, downloading the borrowed funds report online from HDFC netbanking portal was critical for users seeking claim tax deductions. To your mortgage report at your fingertips, people can simply check for eligible income tax write-offs less than individuals areas of the income tax statutes, so it is an essential file having planning and filing taxes. The procedure necessitates the owner’s ID to possess a safe log in, ensuring that the customer’s economic recommendations remains secure.

Insights Their HDFC Home loan Statement On the internet

Lenders can provide the desired assist needed to result in the dream about getting your residence toward an available reality. Immediately following efficiently delivering a mortgage it becomes essential continuously check up on your residence loan comments. Information their HDFC Mortgage report online is essential to have managing your money effectively. It offers a detailed overview of your repayments, showcasing how much of your installment happens into the dominating number and how much talks about the attention. This understanding is very important getting thought taxation deductions and you will making certain you take advantage out of your income tax experts whilst among the many most readily useful benefits of providing a mortgage.

What’s an enthusiastic HDFC Financial Report bad credit payday loan Rhode Island?

An enthusiastic HDFC Home loan statement was a comprehensive document one traces the important points of financing, such as the disbursement count, interest rate, installment tenure, together with summary of for every EMI. They performs a significant part in helping consumers tune their loan improvements and you can plan for taxation deductions effortlessly.

Before you take into the a home loan, it is essential you will do a-deep plunge to your expenditures and have now a clear knowledge of dominating loan amount and you will desire money. A great foresight in this regard is figuring your month-to-month EMI’s getting greatest monetary considered. Of these probably put their houses to the rent may also here are some that’s rent fixed less than lease manage work, for sensible decision-making.

Verify Your Mobile getting Safe Availableness

To be sure the safety of your economic suggestions, it is essential to make certain your mobile number as part of the HDFC Mortgage report supply processes. This serves as a protect, ensuring that merely you have access to your loan declaration online. Shortly after affirmed, you’re getting quick notifications and you may OTPs in your inserted cellular, raising the security of the online financial sense.

The significance of Frequently Checking Your HDFC Mortgage Report

Regular tabs on your HDFC Mortgage declaration is crucial to own staying on top of your finances. It can help you know brand new figure of the mortgage fees, making certain you might be always alert to the fresh new outstanding equilibrium and improvements you’ve made into complete repayment. It vigilance is vital to controlling your own tax deductions effortlessly, since it allows you to pick qualified deductions and you may plan the funds accordingly.

How it Helps in Managing Your finances

Keeping an almost eye on your HDFC Mortgage declaration helps into the best monetary believe. Of the understanding how your repayments is actually designated amongst the dominating and attract, you may make advised behavior regarding the mortgage prepayment otherwise reorganizing if needed. This information is actually indispensable to possess enhancing tax deductions, since it enables you to leverage the maximum possible professionals, ergo cutting your nonexempt money.