-

×

Möbel Genuss Konsol

1 × ₺31,824.00

Möbel Genuss Konsol

1 × ₺31,824.00 -

×

Kaffa Şifonyer

1 × ₺38,251.20

Kaffa Şifonyer

1 × ₺38,251.20 -

×

Neva Yan Sehpa

3 × ₺33,345.00

Neva Yan Sehpa

3 × ₺33,345.00 -

×

Peace İkili Sehpa

1 × ₺32,824.35

Peace İkili Sehpa

1 × ₺32,824.35 -

×

Atlas Dresuar Kitaplık

1 × ₺34,144.50

Atlas Dresuar Kitaplık

1 × ₺34,144.50 -

×

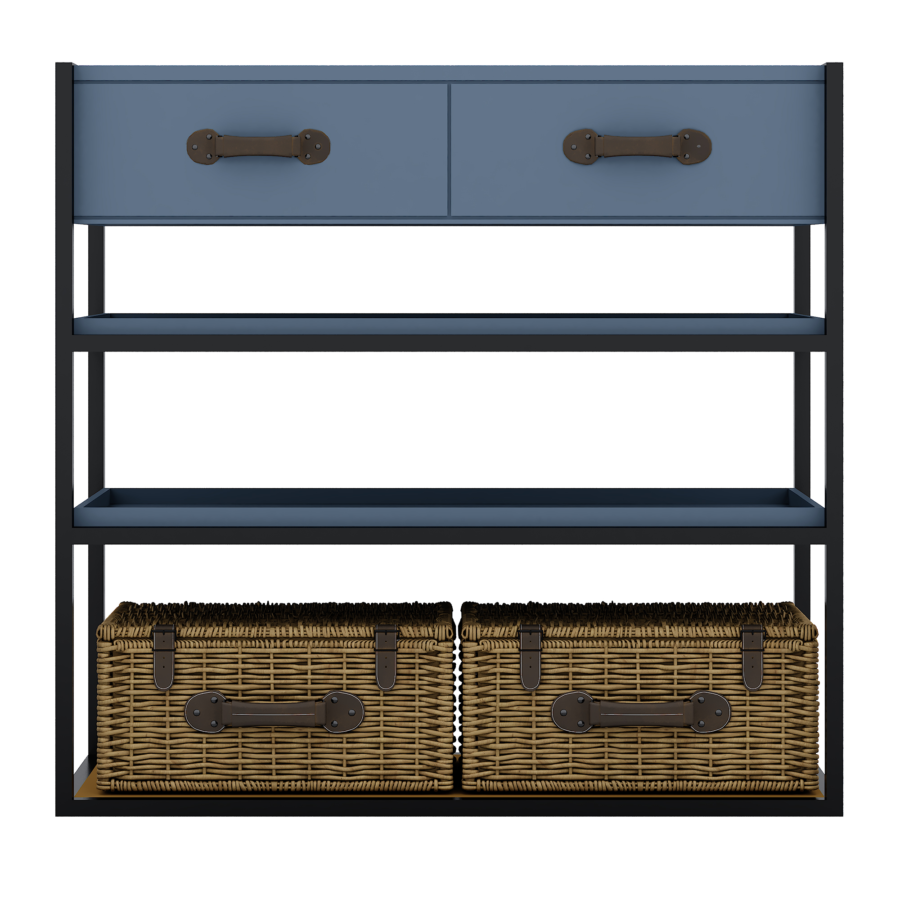

Chicago Çekmeceli Saklama Dolabı

1 × ₺33,481.50

Chicago Çekmeceli Saklama Dolabı

1 × ₺33,481.50 -

×

Atlas Dresuar Kitaplık

1 × ₺36,465.00

Atlas Dresuar Kitaplık

1 × ₺36,465.00 -

×

Möbel Genuss Orta Sehpa

1 × ₺31,028.40

Möbel Genuss Orta Sehpa

1 × ₺31,028.40

Ara toplam: ₺338,053.95