- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

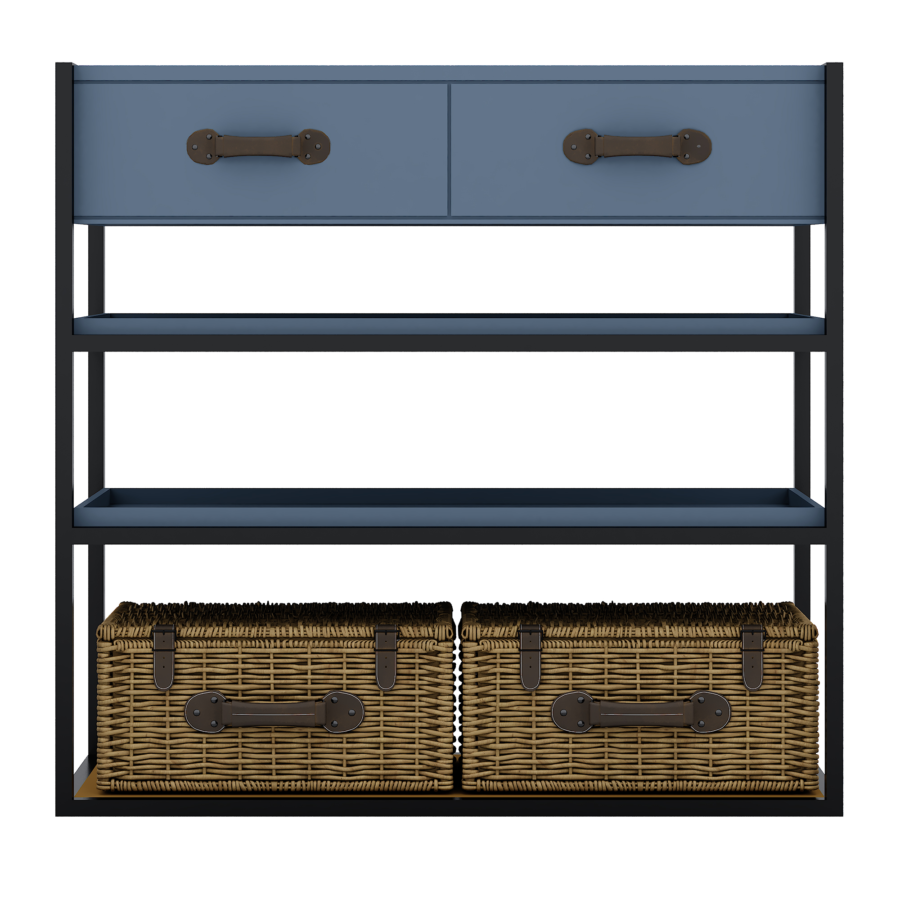

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

Lookin Straight back in the 2023’s Wild Trip to own Home loan Costs, What exactly is In store getting 2024?

Secret Takeaways

- In 2010 noticed financial pricing climb in order to a historic highest, notching its priciest levels once the 2000.

- A minimal period to possess 2023 prices was at March, given that 23-season height found its way to mid-October.

- Rates keeps due to the fact already been tempered by the a dramatic December slip-regarding.

- The brand new pass on anywhere between 2023’s reasonable and you will large averages are more than dos percentage issues towards major repaired-price loan brands, and you may nearly 1.5 fee items with the 5/six Case mediocre.

- Future mortgage prices will always be tough to forecast. But given the Fed’s expectation away from reducing cost in 2024, it is generally anticipated mortgage costs usually simplicity lower the coming year.

A great 2023 Roller Coaster to own 30-Season Financial Rates

Even though it is correct that 2022 try a remarkable year to have 30-12 months mortgage pricing, surging nearly 4 payment facts anywhere between one to delivered 31-seasons mortgage prices towards the historical stratosphere.

The fresh 31-seasons the new buy price mediocre ended 2022 at the seven.17%. But contained in this six-weeks, it had decrease over a portion suggest an excellent 6.11% understanding on the Feb. dos. For a few days a while later, it bobbed to ranging from one lower six% diversity and seven.30% in early February.

However, as their eight.01% reading on 17, the new leading mediocre hasn’t dipped straight back lower than eight%. Tough, on the four days out of mid-may to help you mid october, the newest 31-seasons mediocre skyrocketed nearly another type of 1.5 payment items. Into the October. 17, it peaked in the 8.45%, that is estimated become the greatest top to possess 30-12 months cost because the 2000.

Thankfully, the end of the year features introduced certain escape save having anybody who needs to safer a special mortgage. In a couple months due to the fact October’s historic large-water mark, 30-seasons financial cost have sunk back off so you’re able to regarding eight%. For the each other Dec. 19 and 20, the 30-seasons mediocre seated as low as seven.01%, although average have inched a while large so you can seven.06% now.

Dramatic 2023 Direction for everybody Big Financing Designs

The 29-12 months home loan average was not really the only mortgage types of to see a primary move anywhere between its 2023 level and valley. The FHA 30-season, 15-seasons, and jumbo 31-seasons averages all of the noticed a spread from alot more then dos payment factors anywhere between the reduced and you will large 2023 readings.

The latest duration between your low 5/6 adjustable-rate mediocre of the season and its 2023 high point are less wide, but nevertheless showed a-swing of nearly step one.5 fee points.

Freddie Mac’s Historic Context to have 2023 Costs

Investopedia’s mortgage speed averages is actually every day readings, and simply become zero-section funds. Conversely, Freddie Mac computer posts a weekly mediocre, which blends four early in the day days of rates, and you will has loans valued having disregard affairs.

However, if you are Freddie Mac’s 29-seasons rate average does not deliver the exact same precision given that Investopedia’s mediocre, a helpful advantageous asset of Freddie Mac’s learning was its over 50-season historical list. As it possess tracked 29-season home loan pricing the whole way back into 1971, Freddie Mac is a wonderful investment getting placing today’s prices towards the an old angle.

This years-long rate log is exactly what means that October’s level is this new highest point to possess 30-season the purchase cost because . On Freddie Mac mediocre, the per week peak is actually notched into October. twenty six, that have a training from eight.79%. However, immediately after seven straight months of declines, the new Freddie Mac computer 31-season mediocre features fell over a percentage point out six.67%.

In which Home loan Rates Is On course inside the 2024

Although the Government Reserve’s choices towards the their government loans speed carry out circuitously flow mortgage cost, big speed behavior by Given have a secondary impression about what lenders is actually billing having mortgage loans. Along with the central financial raising its workbench, it’s unsurprising your competitive Provided promotion-also ages-highest rising prices-caused mortgage prices to maneuver drastically highest.

But rising cost of living has now cooled off, and although it isn’t yet during the Fed’s wanted dos% target height, the fresh Provided committee established a 3rd straight speed hold on Dec. thirteen. Furthermore, studies put-out from the Government Set aside you to definitely big date implies that 80% of the committee participants enjoy the newest government loans price was reduce two to four times within the 2024, which have a median anticipate away from about three price slices of 0.25% per.

If or not so it rate movement will occur affirmed is actually unfamiliar. bad credit loan in Stewartville But if the federal money speed truly does come down 2nd season, it is basically expected mortgage costs often ease lower as well. Needless to say, this new magnitude and you may price out-of financial rates decrease remain to rise above the crowd. Shedding dramatically regarding 2023’s number peak can be a slow refuse which will take longer than simply next calendar year.

How exactly we Track Home loan Cost

The fresh federal averages cited a lot more than was in fact calculated in accordance with the reduced price given by over 200 of your country’s most readily useful lenders, assuming that loan-to-worth ratio (LTV) away from 80% and a candidate having an effective FICO credit rating regarding the 700760 assortment. The resulting pricing is actually associate out-of what people should expect to find whenever finding genuine rates away from lenders centered on the certificates, that could start from stated intro cost.

In regards to our map of the greatest state rates, a decreased rates currently offered by a beneficial surveyed financial where state is actually noted, and in case an identical parameters off a keen 80% LTV and you will a credit rating anywhere between 700760.