- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

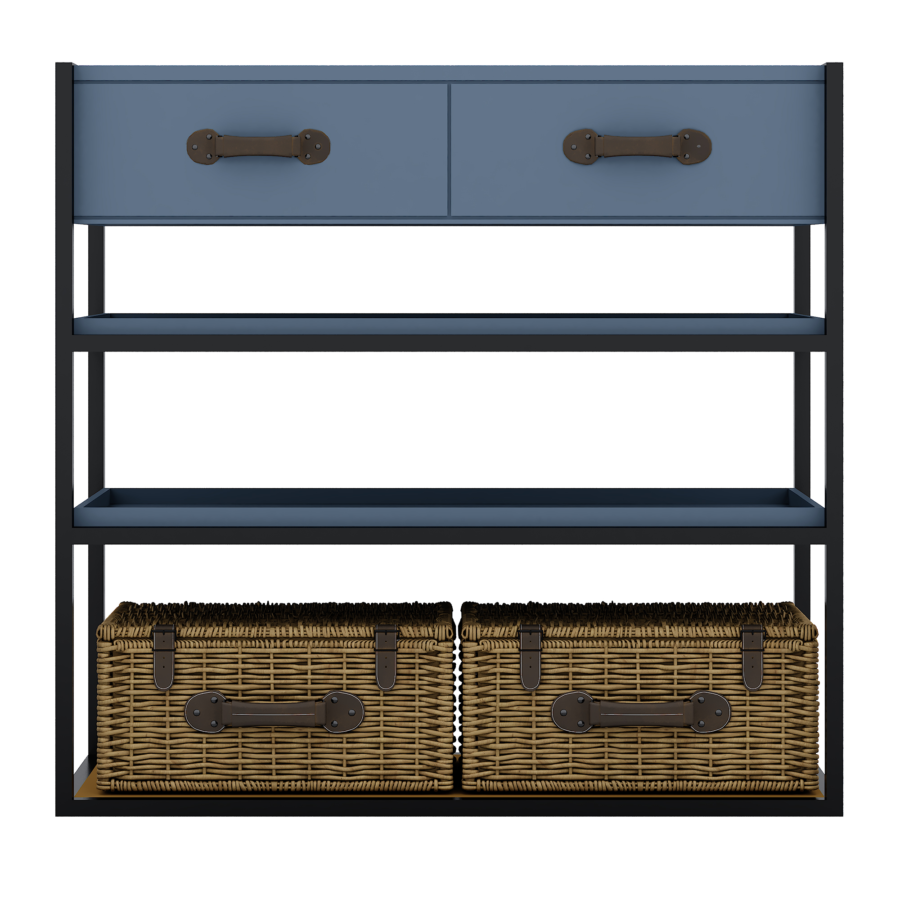

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

In advance Charge: the newest charges billed to help you property owners from the bank during the time from closure a mortgage loan

This may are present to the business of the property, this new pay-off the mortgage in full, otherwise a foreclosures

Virtual assistant (Company regarding Experts Situations): a national company, and therefore guarantees fund designed to experts; similar to financial insurance rates, a loan verify handles loan providers up against loss that can result from a debtor default.

Walk through: the very last evaluation out of property offered because of the client to ensure one to any contingencies given from the pick agreement like since fixes was accomplished, fixture and you can low-installation home is in place and you will prove this new electronic, physical, and you will plumbing work systems come in working acquisition.

Warranty Action: an appropriate document complete with the newest make sure the supplier is the genuine holder of the house, contains the straight to offer the home there are not any says from the possessions.

Zoning: local guidelines dependent to manage this new spends out of residential property contained in this a beneficial style of city. Zoning laws are acclimatized to separate home-based homes from aspects of non-domestic have fun with, such as for example globe otherwise enterprises. Zoning ordinances are of numerous conditions governing such things as style of structure, setbacks, lot proportions, and uses of a building.

Broker: a licensed personal or organization one charges a charge to serve because intermediary within buyer and you may seller. Mortgage brokers try some one in the market of planning capital otherwise settling contracts to possess a person, however, who does not loan the bucks. A bona fide estate broker try somebody who facilitate discover a property.

Comparative Business Analysis (COMPS): property evaluation you to decides property value by researching comparable features offered over the last year.

Default: the shortcoming while making punctual month-to-month mortgage payments otherwise follow that have mortgage words. A loan is in standard whenever fee has not been paid shortly after 60 so you can 90 days. Immediately following inside the standard the financial institution can be exercise liberties outlined when you look at the the latest deal to begin property foreclosure proceedings.

Equity: an user’s monetary demand for a house; computed because of the deducting the quantity still owed towards the financial loon(s)about fair market value of the house.

GSE: acronym getting bodies paid enterprises: some monetary services agencies shaped because of the Us Congress to reduce interest levels having producers and you can property owners. Examples include Federal national mortgage association and you may Freddie Mac.

Index: the fresh way of measuring interest alter that the financial uses so you’re able to regulate how far the pace of a supply will vary over the years. No one can be sure whenever a list price goes upwards otherwise off. You should pose a question to your lender the way the directory for your Case you are considering has evolved in recent years, and you may in which its claimed.

Loan Velocity: a speed condition during the that loan document was an announcement for the a home loan that provides the lending company the legal right to demand payment of entire a great equilibrium when the a payment is actually skipped.

Mortgage Advanced (MIP): a payment -always an element of the homeloan payment paid by the a debtor for home loan insurance coverage.

PITI Reserves: a finances count that a debtor have to have available to you immediately following and come up with a downpayment and you may paying all the settlement costs to your acquisition of property. The main, appeal, taxation, and you may insurance rates (PITI) supplies need certainly to equal the quantity that the debtor will have to purchase PITI to have a predefined amount of weeks.

Prepayment: people count reduced to minimize the principal harmony off financing till the due date otherwise commission completely regarding a home loan. When you look at the for every instance, complete percentage occurs through to the financing could have been completely amortized.

Refinancing: paying off that loan of the acquiring a unique; refinancing is done to safer best loan terms and conditions (such as for instance a lowered interest rate).

If the a lender bases rate of interest customizations into the average value away from a catalog throughout the years, the interest rate wouldn’t be because volatile

Underwriting: the process of checking out a software to search payday loan Coral Springs for the number of chance involved in putting some loan; it gives a look at the possibility borrower’s credit history and you can a view of the house value.