- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

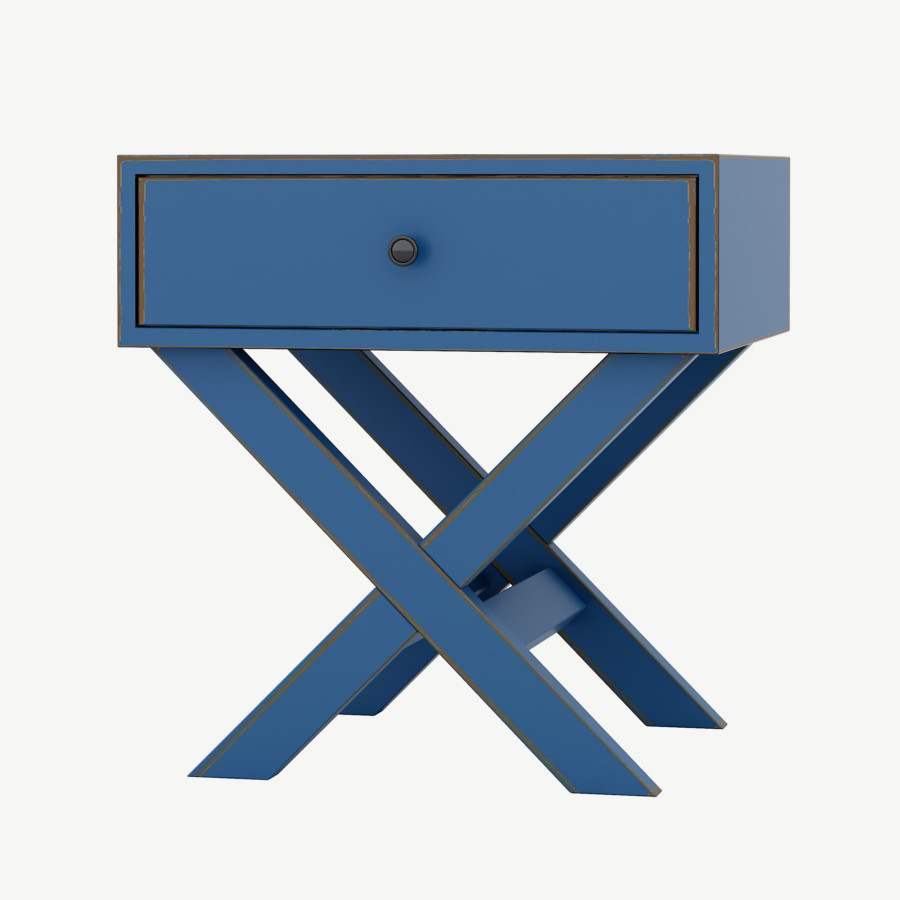

Piccolo Komodin

Piccolo Komodin

₺22,420.00₺16,575.00

-

- Yaşam Tarzı

5 ways to get over your house Financing rapidly

Home ownership rocks, but truth be told, discussing a mortgage for some time will likely be a money-drainer. Listed below are five easy an effective way to pay it back quicker and you will rescue some money toward interest:

step one. Create more money

Try to make more costs whenever possible. It means using over minimal EMI number or and also make lump sum repayments whenever you possess excessive funds. By doing this, you could reduce the principal quantity of the loan while the notice one to accrues on it.

Believe a scenario the place you hold a mortgage of Rs 90 lakhs with an intention rate of 8.5% over a thirty-seasons several months, causing a month-to-month EMI around Rs 69,202. If you generate an additional payment per month away from Rs 10,000, the borrowed funds are going to be totally paid back for the 19 many years and you may cuatro months. This strategy manage result in big savings, which have a whole focus reduction of more Rs 65 lakhs.

Yet not, before you personal loans online Washington make extra money, check if there are any prepayment charge or constraints. Home loan loan providers also Axis Financial do not costs any prepayment penalty should you choose a drifting rate of interest.

2. Go for an equilibrium import

A balance import transmits your own an excellent mortgage out of a current bank to some other providing a lowered rate of interest otherwise better terms and conditions and you will requirements. This can aid in reducing your own EMI matter as well as the full attention payable on the mortgage.

- The difference between the attention cost offered by your existing and you can the fresh financial. If at all possible, the difference are going to be about 0.5% to at least one% to make the equilibrium transfer worthwhile.

- The brand new control fee, stamp obligation, legal fees, and other costs are active in the harmony transfer.

step three. Improve your EMI matter occasionally

A third way of getting more your home mortgage easily is actually to boost the EMI matter from time to time. This means purchasing a top EMI count annual otherwise every pair months, dependent on your earnings gains and you will affordability. By doing this, you might reduce the principal level of your loan reduced and the eye one to accrues with it.

cuatro. Use your windfall income

Windfall income was people money you get abruptly or sporadically, particularly incentives, bonuses, gift suggestions, inheritance, otherwise lottery profits. not, prior to with this means, take into account the following the affairs:

- Their liquidity and you will emergency means. Make an effort to has a sufficient crisis money to cover at the least half a year of cost of living and you may people unanticipated costs.

- Attempt to prioritise paying the other large-focus loans, eg handmade cards.

- Disregard the opportunities. Should your production is greater than the interest, you might be best off paying the windfall income during the an excellent suitable option, such shared money, holds, or ties.

5. Like a shorter financing period

Choose for a loan fees several months less than the maximum offered period. Yet not, a shorter loan tenure mode a top EMI count, that may filter systems the monthly budget and cash move. You should merely choose that loan tenure in your cost capability, and therefore affects your life style and you will discounts.

Conclusion

Home financing is a big commitment that will connect with their earnings and you can assurance. not, following the methods said prior to, you should buy more your home loan easily and you will spend less on the attention.

Disclaimer: This information is to have advice objective merely. New opinions indicated in this article is actually private and do not fundamentally form this new opinions out of Axis Lender Ltd. and its own staff. Axis Lender Ltd. and/or even the author shall not be responsible for people lead / secondary losings otherwise accountability obtain of the reader to take people economic conclusion based on the material and you may recommendations. Please check with your economic advisor before making any financial choice.