- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

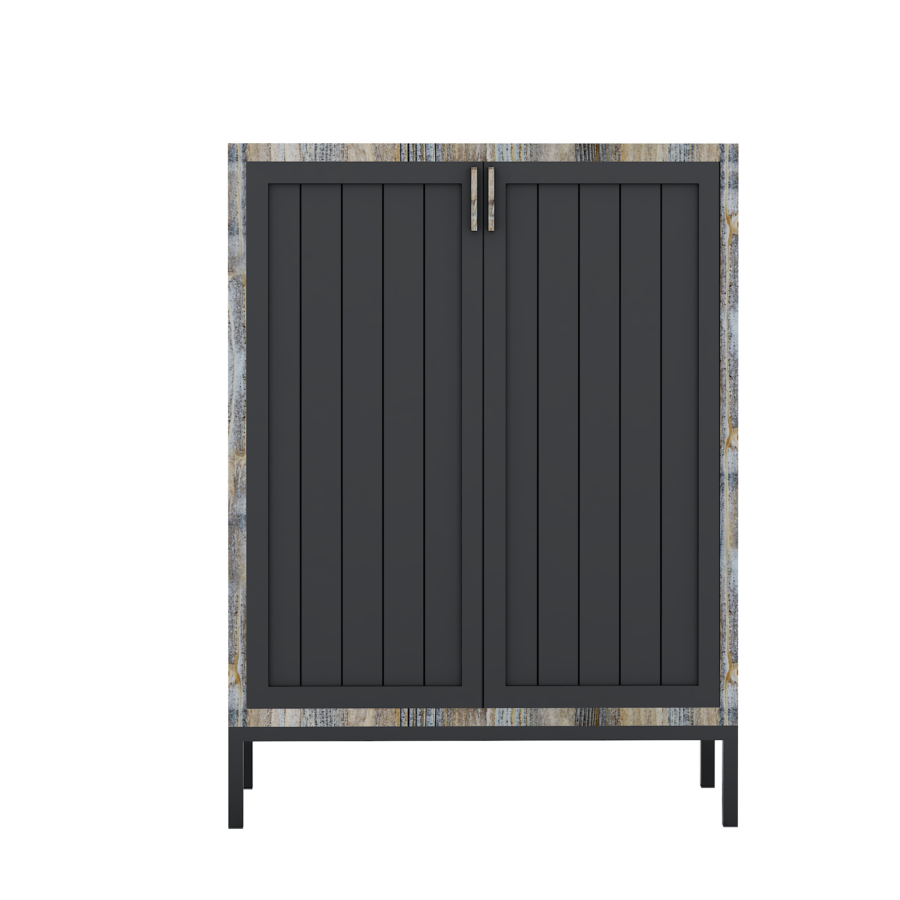

Ladin Dolap

Ladin Dolap

₺40,280.00₺33,150.00

-

- Yaşam Tarzı

Look at the Credit file and you will Credit rating

“Step one is to try to consult a loan provider to aid know if you are entitled to refinance, just like the ‘bad credit’ doesn’t indicate ‘unacceptable borrowing from the bank.’ Eg, some folks has lower credit scores due to medical loans, case of bankruptcy, id theft, and/or repossession off an automible that was a good ‘lemon,’ ” Rice-Wilkerson told you. “We can normally works to these scenarios.”

Before applying the borrowing from the bank, it certainly is a good idea to check your credit reports. It is really not uncommon to track down problems on them, many of which can even hurt your credit rating.

From the selecting one credit file mistakes very first, just before a loan provider you’re using having do, you can take the appropriate steps to solve the brand new errors thus you are not getting unfairly punished.

Reduce Existing Personal debt

While able, one thing you are able to do to greatly help your credit score nearly instantly is to reduce people debt you really have, especially credit card debt. An entire 31% of one’s credit rating consists of the level of currency your debt, so reducing which count might help.

Rating Borrowing for rent and you can Resources

Your credit rating doesn’t typically make up points that your might be really good on handling, just like your statement payments and your savings account. One to stands for a missing out on window of opportunity for strengthening credit. However, today, you’ll find applications such as for example Experian Increase and you will UltraFICO that do enables you to add in such membership, that will potentially assist your credit rating.

Pose a question to your Credit card companies having Large Limitations

And the sum of money you borrowed from, some thing which is vital contained in this category is how far you borrowed from in accordance with your restriction; in other words, exactly how close you are to maxing out your playing cards.

It is labeled as the borrowing usage rate, by increasing your credit card constraints, it seems like you are borrowing a lesser amount of the financing you have available to you. Just remember to not ever spend doing that this new restriction once again, or you’ll be right back for which you become, except with increased personal debt.

Score Assistance from an official Borrowing Therapist

When you are having trouble together with your money and you’re not yes where to start, conversing with a credit therapist specialized through the National Basis having Credit Guidance may help. Oftentimes, the assistance is free.

How exactly to Re-finance Your Home loan

For those who have less than perfect credit, refinancing the mortgage are working comparable in terms of some one else, however with you to definitely exception to this rule: Looking around to discover the best deal is also more significant. Here’s how to do it.

Search for Prices

“Check around and correspond with several loan officials. Just because individuals is wanting to offer you a mortgage does not suggest it’s value to get,” Rice-Wilkerson said. “See that loan manager you can rely on, one who works together people such as your self, and take they action-by-action.” A state housing authority could be a beneficial place to check for loan providers that can help.

Favor a lender and you will Over The job

After you have receive a loan provider which have who you are comfortable and who can offer an educated rates, you could setup a full re-finance application.

Since your credit history was weakened, your financial might need that render significantly more records or answer particular concerns, so stay static in intimate contact with these people.

Start Costs on your own The Financial

After you will be accepted, you can visit closing in order to signal the past documents, same as when you first took out your financial. banks in Wyoming that offers personal loans online Your new lender pays from your old financial, and you’ll begin making repayments on your own this new mortgage. Always create autopay and that means you don’t have to value remembering and make your repayments; this will help you generate borrowing.