- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

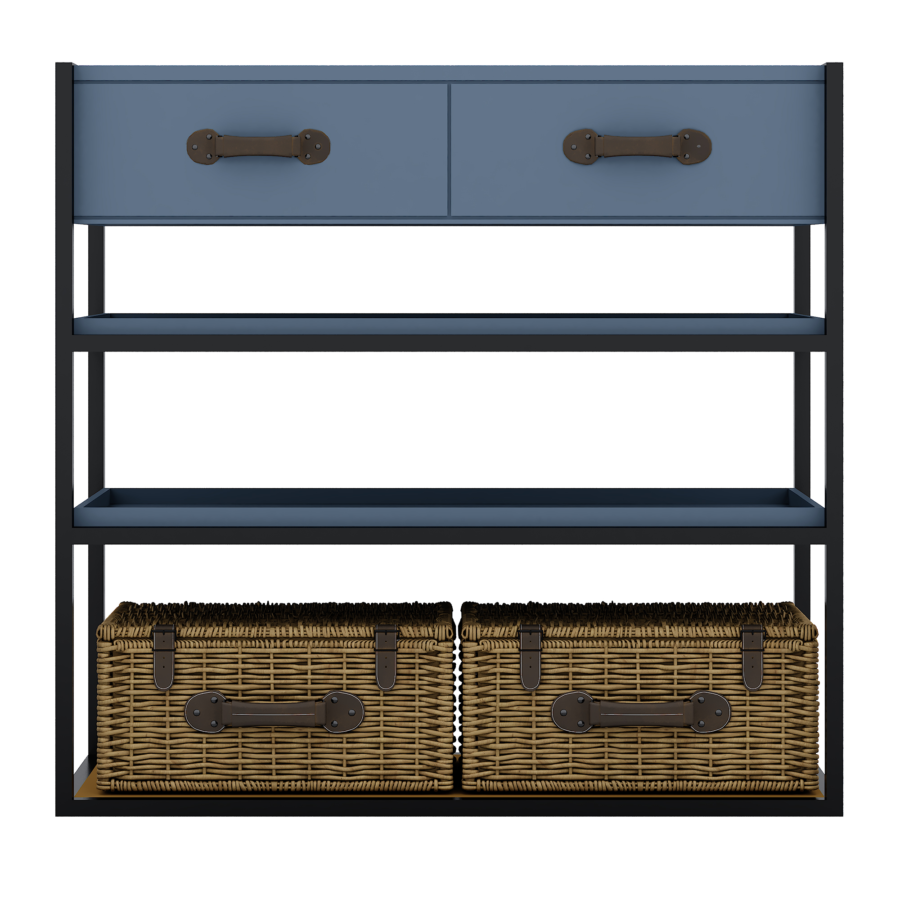

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

National Homebuyers Finance Offers and you may Finance | 2024

Of a lot optimistic property owners are stuck outside the houses market’s doorway as a result of the decreased bucks to have off money and you can closing costs.

The fresh new Federal Homeowners Funds (NHF) shines in general particularly effort, with distributed millions of dollars once the the organization in 2002 to help family from inside the recognizing its desire homeownership.

As well as the cherry on the top? NHF provides and you will finance generally none of them payment, effortlessly delivering being qualified those with 100 % free financial help.

What’s the Federal Homebuyers Fund?

Based on their web site, the new NHF was created to stimulate and develop homeownership potential and bolster groups across the country. They plans people who find affordable property help, in addition to very first-day people.

Since the the manufacturing, the fresh new NHF gave more $461 mil in the down-payment help qualified individuals. Additionally, it has aided more 52,600 people otherwise families during the to shop for a property.

The new NHF could offer guidelines to 5% of your home mortgage count. So if you got an effective $350,000 mortgage, eg, this new NHF might give you around $17,five-hundred once the a grant otherwise forgivable mortgage to support your initial will cost you.

Ca customers may also make use of almost every other NHF software, including financing having energy savings domestic updates, bringing a home loan Borrowing from the bank Certification (MCC), and extra downpayment guidelines.

Just how NHF grants functions

Brand new NHF would depend from inside the Sacramento, ca, Calif., but members of the fifty says normally pursue downpayment and you will closing pricing assistance from the new NHF. Referring in 2 forms:*

- An offer of up to 5% of your own last amount borrowed: Has is actually free plus don’t need to be repaid, cards Anna DeSimone, author of Inhabit property you to definitely Will pay Your Right back

- An additional home mortgage with 0% attention that’s forgiven immediately after three years: It next financial is generally big enough to pay for their deposit otherwise settlement costs

Which have an effective forgivable loan, you don’t have to pay any prominent or appeal – definition, you never pay it off at all – for many who comply with the new program’s limitations. Chiefly, you must stay in the house an entire 36 months it needs the loan become forgiven.

Forgivable finance assist home buyers protection their initial costs, DeSimone says. Right after which every year, for quite some time, a certain portion of the mortgage harmony is forgiven, up to it is located at no.

In order to qualify for a give otherwise financing on Federal Homebuyers Loans, you have to meet a few very first standards. Thankfully, they aren’t as well rigid:*

- It’s not necessary to getting an initial-big date buyer is eligible

- The amount of money limits try greater than expected, because system is concentrated so you’re able to reduced-money as well as modest-income individuals

- The fresh new FICO score minimal and you will obligations-to-income proportion maximums try seemingly flexible: 640 and you will 45%, respectively

- The help can be used for conventional mortgage loans as well because FHA, Virtual assistant, and USDA loans

- NHF direction loans is going to be combined with most other, non-NHF mortgage guidelines programs

Discover one out of your area by asking your actual property broker, or by getting in touch with the fresh NFH at the their cost-free number: (866) 643-4968.

Cons to look at

You have got to remain in the home for around three decades. So if you intend on swinging or refinancing appropriate to find your property with NFH fund, stay away.

Along with, already, the support are used for a property buy but not an excellent re-finance. And just a choose amount of acting lenders provide NHF recommendations. Therefore you will have slimmer pickings while shopping around for an educated rates.

Choice for the Federal Homebuyers Money grant

Or even be eligible for an NHF offer – or, you are searching for more assist with supplement you to – there are plenty of most other first-date home visitors software available.

Otherwise, you can travel to downpaymentresource to find assistance information close by you can be eligible for centered on your own borrowing from the bank and you will earnings.

According to the program given, usually, the very least credit score away from 640 is required, and there try income constraints you to are very different because of the state. And you will usually, this type of other companies promote recommendations anywhere between step 3% and you will 5% of one’s purchase price so you can eligible individuals, states Randall Yates, President of one’s Loan providers System.

Seek the advice of local programs close by

Ryan Leahy that have Home loan Circle plus advises contacting the fresh homes expert into the municipality what your location is to buy. This type of companies can help you select closure prices and you can deposit recommendations applications that not be widely known.

Look closely at requirements that may need to be came across, like doing an initialbig date house customer category, recommends Leahy.

Lastly, if or not your go after NHF money if not, make sure to work with that loan administrator that has experience dealing with earliest-go out home client offers and you can deposit guidance programs, Leahy adds.

Either, these software makes the home loan a little more challenging to help you coordinate and ensure all the fund are prepared to have closing, he says.

Having financing manager who has already familiar with the procedure commonly create everything go better. But not, you’ll find tend to procedures just take on your own – for example doing a property visitors degree course – therefore you should get in touch with new NHF prior to getting arrive at make yes you realize the measures necessary.

- FHA money: Such wanted only 3.5% off when your FICO rating was 580 or even more

- USDA money: You should buy without deposit into the qualifying outlying areas while you earn a method money; might you would like a 640 credit score with many mortgage lenders

Just what are the current mortgage costs?

Getting your first house is a big deal. Regardless of if pricing try higher now, record signifies that home owners always benefit in the long run.

With down-payment and you can closure cost assistance, the whole property processes might possibly be a whole lot more reasonable than just your imagine.