- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

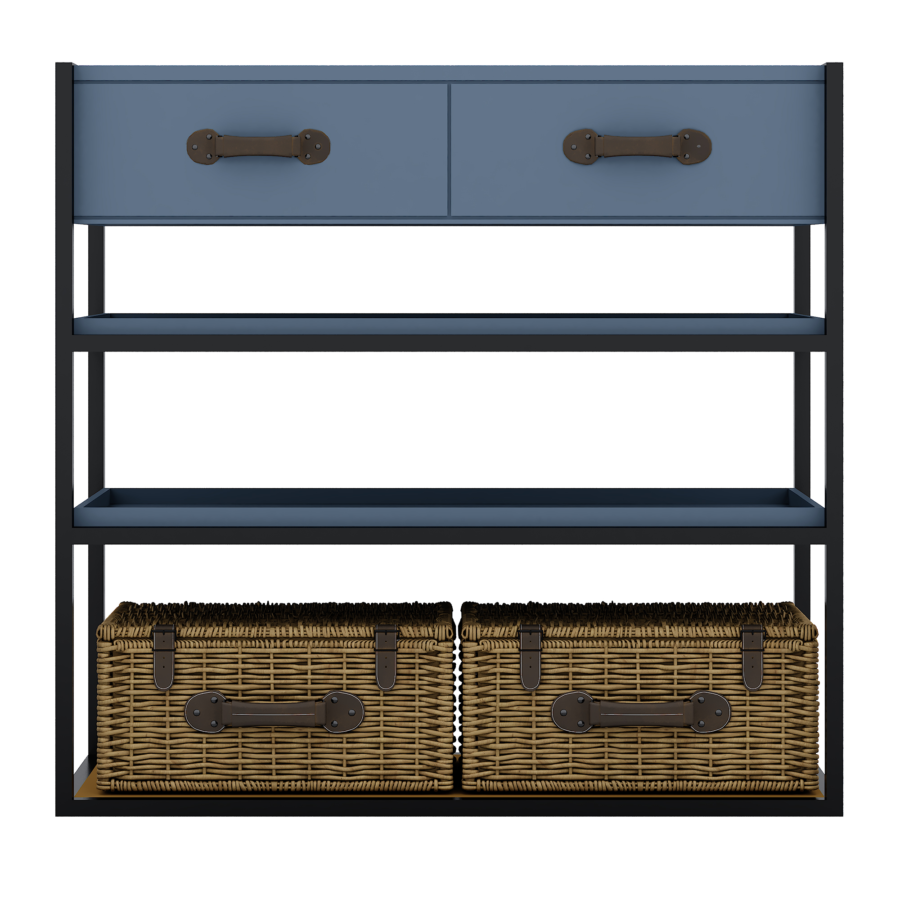

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

100 LTV home collateral mortgage: You’ve got genuine alternatives

You may look for numerous posts once you seek out the expression 100 per cent LTV family collateral loan (HEL). However,, once you click on through, you Visit Your URL can see which they simply say you can not have one. This information explains there are how to get the credit you would like, and you can where to search.

LTV means mortgage-to-value ratio. That is the percentage of the current market price of the home you should fund. Therefore a beneficial 100 % LTV financing is but one which allows your so you’re able to obtain a total of 100 percent of your property value.

Once you curently have home financing against your house, and you also need certainly to acquire additional cash, you can pull out property collateral financing. It is also named an effective “next mortgage” since you still have very first home loan.

Suppose that you reside worthy of $150,000, as well as your home loan equilibrium was $100,000. A good 100 LTV domestic collateral loan will give your $fifty,000 inside cash. The loan stability perform equivalent your residence worth.

Figuring your LTV in addition to property value your residence

To understand exactly how much you can use additionally the LTV that means, you need to know exactly how much you reside worth. You can aquire a concept in different ways:

- Using an on-line valuation model (AVM) for example Real estate professional or Trulia

- Lookin public record information for present conversion process off equivalent land on your own neighborhood – to evolve to possess differences when considering your house and the ones

- Picking the latest brains of an informal real estate agent

Remember that that is a crude guess. Their lender will likely require an appraisal ahead upwards along with your property value. Including, just remember that , most loan providers doesn’t provide up against more than 80 or ninety percent of your house value.

100 per cent family collateral mortgage isn’t (quite) a pipe-dream

It might seem your chances of wanting a 100 LTV domestic guarantee mortgage was about like your own glimpsing a beneficial unicorn or good squadron out-of traveling pigs. But they might be a bit much better than one. Not much, but a while.

When, in the , The mortgage Reports performed a search for lenders that have been providing a 100 LTV family guarantee financing, i found two within a few minutes. KeyBank and Lender out of Oklahoma. Both are throughout the Government Put Insurance policies Organization’s database from financial institutions.

And another of them states it’s the device having “zero closing costs.” (These two links worked during the time of composing although lenders might have altered the fresh even offers otherwise discontinued all of them by big date you click through. Look for options.)

Several swallows do not a summer time make. As well as the Government Change Payment recommends, “Extent you could use usually is restricted to help you 85 percent of your security of your house.”

Certain downsides

Just because a lender advertises something, that does not indicate of numerous customers have a tendency to meet the requirements. Of an effective lender’s point of view, a great 100 LTV house guarantee mortgage is short for a stack of chance. In the event the home values slide actually a while, the lending company has a tendency to remove if this has to foreclose on the financing.

- With a really high acceptance endurance getting applicants – You will likely you want advanced credit, nothing in the form of other debts, and you will a beneficial and secure income one makes you plenty out-of spare currency at the conclusion of every month

- Asking a top-interest rate otherwise charges – Those commonly compensate it towards loss it could create with the crappy money

Envision laterally

If you can’t become approved to possess a good 100 LTV home collateral loan, or perhaps the package you’re considering is actually high priced, dont give-up. Depending on your position and factors, and you may exactly what you’ll spend money on, there is certainly possibilities:

Personal loans – Signature loans are perfect because they are not tied to the newest possessions anyway. That means you’ll have very little guarantee at your home – or no equity anyway – whilst still being end up being approved. Financing quantity increase so you’re able to $100,000, and approval goes a lot faster than just with household equity finance.

FHA 203(k) system to have home improvements – This refinance spends the fresh new estimated value of your property after you’ve produced advancements since the cause for the LTV

Va cash-away fund – The fresh new Experts Government lets 100 % bucks-aside refinancing. As eligible, you truly must be a support user, a seasoned or in a being qualified class (age.grams. an excellent widow or widower of somebody qualified)

Contrary mortgage loans (a beneficial.k.an excellent. household collateral conversion home loan or HECM) – Residents 62 or over have access to the guarantee within this novel method. One of these brings a monthly earnings provided you live in your home. Over the years, you might also get more compared to the property’s worthy of. While never have to build money

Common really love arrangements – such allow you to borrow on your future domestic security. As an example, you can borrow $10,000 facing your $100,000 domestic, when you find yourself agreeing to settle the loan harmony together with 25 percent away from one property value increase in, state, five years. (It’s all flexible.) In case your family worthy of increases because of the $twelve,000, you are able to pay-off $13,000.

Given your options

All these comes with its very own advantages and disadvantages. You could only use a keen FHA 203(k) financing to own a set a number of home improvements. You may not be eligible for a good Virtual assistant loan or reverse home loan – and something might not fit you when you are. And you can a discussed adore arrangement form you happen to be finalizing away a portion in the what’s probably your most significant house.

Nonetheless, it’s important to talk about your entire possibilities before you can ultimately choose your sort of borrowing. After all, you happen to be getting your house at stake. And is a method towards the hence it’s worthy of paying a bit having thinking and you will researching.