- Tüm Ürünler

Mutfak

Oturma Odası

Yatak Odası

Giriş Mobilyası

Banyo

Çalışma Odası

Aksesuarlar

-

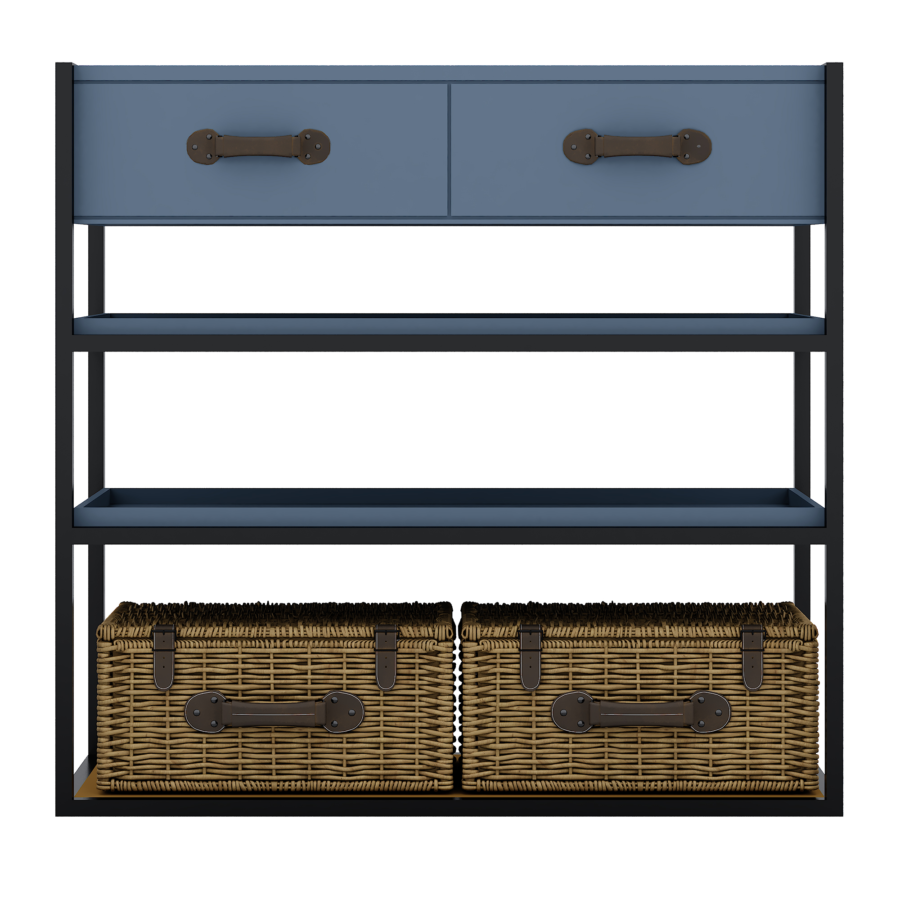

Atlas Dresuar Kitaplık

Atlas Dresuar Kitaplık

₺44,840.00₺36,465.00

-

- Yaşam Tarzı

Eventually, the secret to a profitable NAV borrowing from the bank studio is dependant on the liberty and you can adjustment of the structure

Because the NAV borrowing studio sector will continue to develop, i greeting further designs inside the guarantee formations, potentially as well as improved access to hybrid formations you to merge components of old-fashioned NAV and you may registration line organization

Lenders may also turn to an economically practical father or mother entity or trader of these borrower so you can economically backstop such as for instance borrower’s loans. That it support generally comes in the type of either a warranty otherwise a guarantee commitment. 9

Guaranties may come a number of versions, and (a) percentage guaranties, for which a loan provider can get find commission right from the fresh financing rather than any obligations to help you earliest look for commission regarding borrower; (b) range guaranties, significantly less than and therefore a lender need to fatigue their cures up against the debtor just before trying to payment regarding loans; and you will (c) bad-boy guaranties, in which repayments from the funds only be required should your lender’s loss result from particular bad-serves otherwise misrepresentations of your protected debtor.

Will, but not, a guarantee isnt a practical service because it matters as loans into the guides and information of your finance. Given that a keen alterative, yet not, parent loans will often provide an equity dedication to a beneficial NAV debtor (often directly in the brand new NAV borrower’s component data files otherwise thru an enthusiastic guarantee relationship page). In the place of a guaranty, that’s produced in prefer out of a lender and you can where the money is actually a primary counterparty away from a lender, counting on an equity union borrows the brand new guarantee framework regarding an excellent antique membership facility (we.age., new borrower pledges their legal rights to-name, impose and you will assemble toward father or mother fund’s guarantee partnership). People method using a collateral union would be to concentrate on the same key terms that will be needed for subscription borrowing place (we.elizabeth., the obligation to fund instead setoff, counterclaim otherwise security, having the financial being a share third-cluster beneficiary, an such like.), while structuring equity commitments, consideration will be reduced to make them enforceable and you will give important recourse into financial.

This new varied guarantee and you may restrictive covenant possibilities within the NAV borrowing place expose each other opportunities and you can demands for loan providers and individuals. NAV loan providers can influence variations away from equity, eg guarantee interests, payment channels, and you can put levels, in order to safer their loans if you are consumers have access to expected exchangeability instead of disrupting the financial support ranks. An intensive knowledge of the huge benefits and you may prospective pressures in the for each and every variety of security and you can limiting covenant is very important to possess successfully structuring NAV borrowing organization. Loan providers need to very carefully measure the novel qualities of each package, the fresh borrower’s financial wellness, indebtedness that will can be found that can perspective restrictions, additionally the asset pool’s character and you may restrictions to determine the really effective mixture of security and you will covenants.

By creating this new security and you can covenant bundle into particular products available, loan providers is decrease dangers and borrowers can achieve i desperately need a loan today their financial support requirements. Both parties is take part in lingering discussion and homework to conform to modifying business criteria and make certain the latest a lot of time-name popularity of this new business. NAV borrowing from the bank business provide an effective financing product getting excellent buyers, provided that each other lenders and you will consumers are well-versed on ins and outs off collateral formations and restrictive covenants. Because of the staying informed and agile, business professionals normally browse the reasons out of NAV borrowing from the bank business and you may capitalize on its potential advantages.

A warranty is a contract because of the an economically practical mother organization to help with the new repayment out of a borrower’s a great debt to an excellent bank

2 Tend to, when your borrower is actually a subsidiary aggregator vehicle out-of a larger financing, loan providers have a tendency to look for an equity interest in this new borrower alone, followed by a guaranty and other loans-height recourse, including the directly to call funding setting the loans.